What Is the Commodity Channel Index (CCI)

Understand how CCI works, when to use it, and how it compares with other oscillators in your trading toolbox.

Technical indicators are essential tools for traders who want to make informed decisions without relying on guesswork. One of the lesser-known but highly effective tools is the Commodity Channel Index (CCI). Despite its name, it’s not limited to commodities — CCI can be used on any chart, including forex, stocks, and indices.

In this article, we’ll break down:

What the Commodity Channel Index is

How it works

When to use it

How it compares to other oscillators like RSI and Stochastic

How our EasyIndicators app can help you make the most of it

What Is the Commodity Channel Index (CCI)?

The CCI is a momentum-based oscillator developed by Donald Lambert. It measures how far the current price has moved from its historical average. In simple terms, it helps you spot when a market is either overbought or oversold and could be due for a reversal.

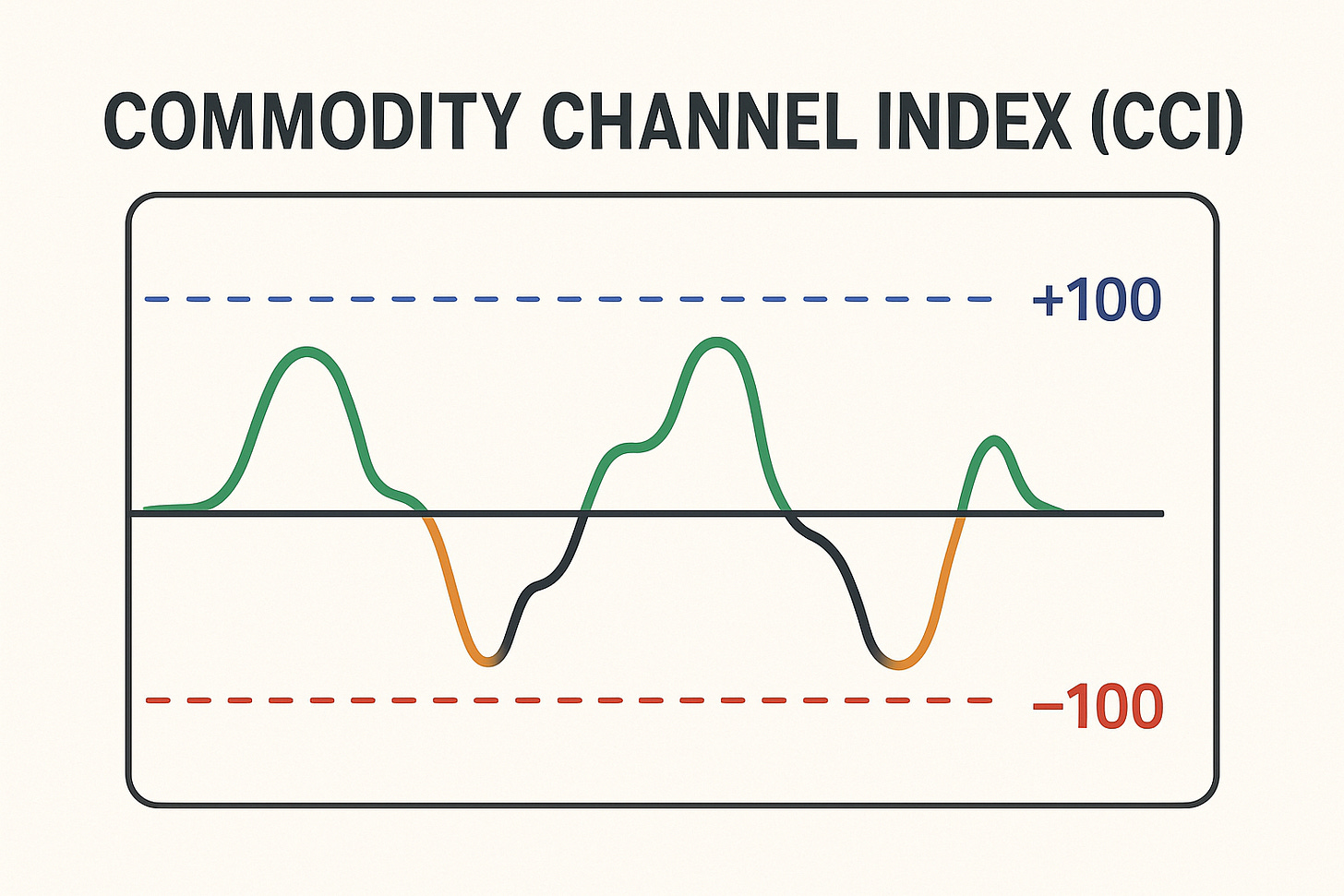

The CCI scale typically ranges between +100 and -100.

Above +100 = Possible overbought condition

Below -100 = Possible oversold condition

But unlike RSI or Stochastic, which are bound within a fixed range (like 0 to 100), CCI is unbounded. It can spike above +300 or drop below -300 in strong trending markets —and that flexibility gives it an edge in certain scenarios.

How Does It Work?

Here’s a simplified explanation of how CCI is calculated:

It looks at the typical price (average of high, low, and close).

It calculates a moving average of that typical price.

It measures how far the typical price deviates from the average.

The result is divided by a constant to normalize it.

But you don’t need to calculate any of this manually — our apps do the math and show you the signals in real-time.

What you do need to know is how to read the signals:

When CCI crosses above +100, it suggests strong bullish momentum — possibly a breakout.

When CCI drops below -100, it indicates strong bearish momentum — possibly a breakdown.

When CCI moves back within the -100 to +100 range after an extreme, it may signal the end of a trend.

When Should You Use CCI?

1. During Trend Reversals

CCI is great for spotting turning points. If the price has moved too far too fast, the CCI will catch that early and give you a heads-up before the market corrects itself.

2. For Spotting Divergences

Just like RSI or MACD, the CCI can be used to identify divergence, when the price moves in one direction but the indicator moves in another. This often hints at a weakening trend.

3. In Range-Bound Markets

It also performs well when markets are stuck in a range. Repeated bounces above +100 or below -100 can signal potential reversal zones for short-term traders.

CCI vs Other Oscillators: Why Choose CCI?

Choose CCI if you want an oscillator that reacts faster to price extremes and isn’t limited by a fixed range. It’s especially useful if you trade multiple markets and want a broader view of momentum, not just bound within 0–100.

How to Use CCI with the EasyIndicators App

If you're new to trading or just want a simpler way to apply CCI, our EasyIndicators app makes it easy:

Multi-timeframe CCI signals: See how the indicator behaves on M5, M15, H1, D1, and more.

Push notifications: Get alerts when CCI crosses key thresholds (+100/-100).

Clear signal summaries: Know at a glance which pairs or instruments are potentially overbought or oversold.

Our app is designed with beginners in mind, no clutter, just clean and useful data that helps you trade smarter.

Final Thoughts

The Commodity Channel Index might not get as much attention as RSI or MACD, but it’s a powerful tool when used correctly. Its flexibility and sensitivity to price changes make it a valuable part of your trading strategy, especially when you understand when and why to use it.

If you haven’t tried using CCI before, give it a shot inside our app. See how it behaves alongside your other indicators and decide if it earns a permanent spot in your trading routine.

Easy Dashboard (Android)

Easy Dashboard (iOS)

Easy CCI (Android)

For support, contact us at support@easyindicators.com.