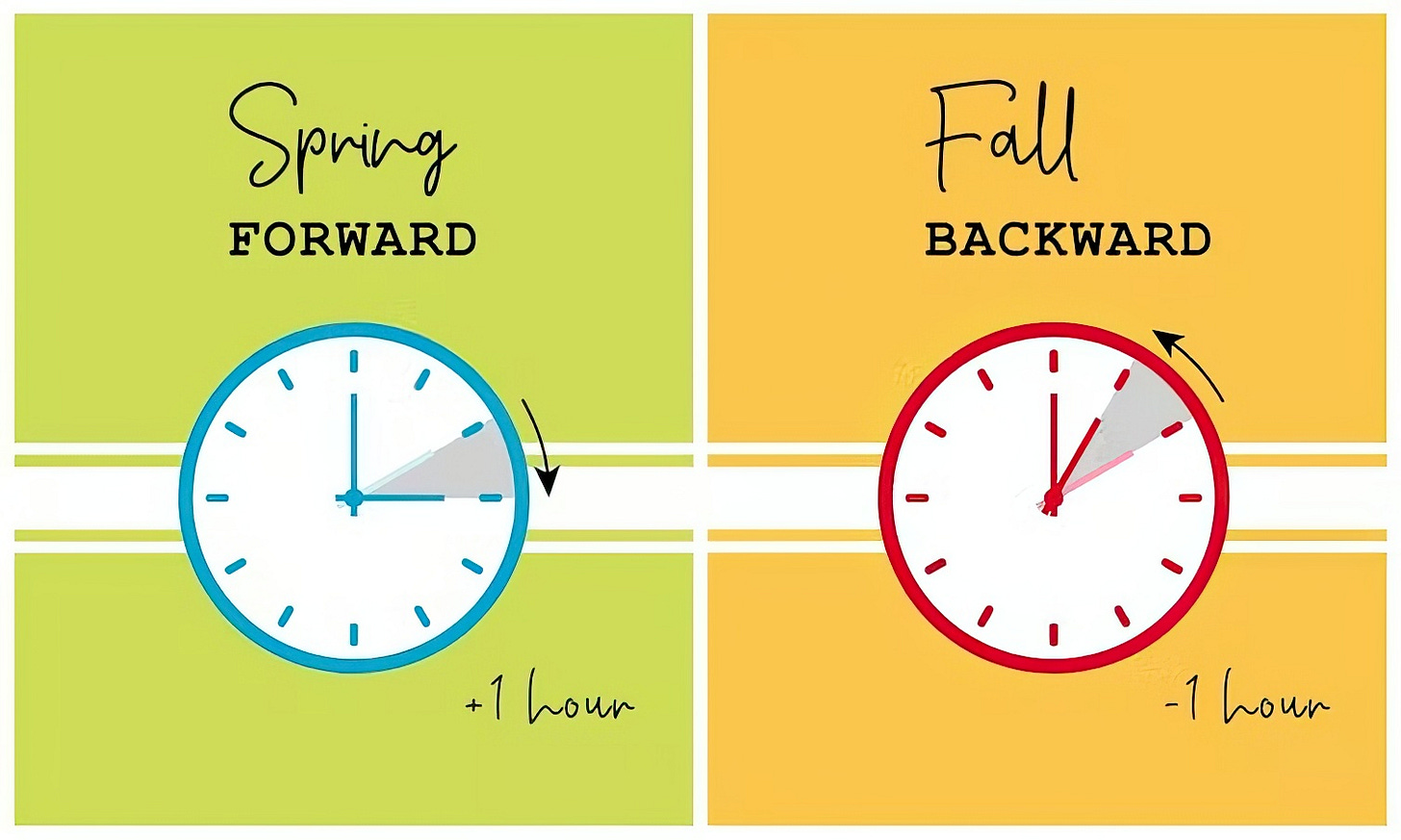

If you trade forex, you may have noticed that market hours shift a bit around March and November each year. That’s because of Daylight Saving Time (DST), which affects trading hours across different regions. Understanding these changes can help you adjust your trading strategy and avoid unnecessary surprises.

When Does Daylight Saving Time Start in 2025?

In the U.S., clocks will move forward by one hour on Sunday, March 9, 2025, at 2 a.m., jumping ahead to 3 a.m. This means the U.S. trading sessions, including the New York Stock Exchange and key economic events, will occur an hour earlier for traders in regions that do not observe DST.

Europe follows suit a few weeks later, with DST starting on Sunday, March 30, 2025. Until then, there will be a temporary mismatch in market opening and closing times between the U.S. and Europe, affecting session overlaps and liquidity.

How Does This Impact Forex Trading?

1. Shifted Market Hours

The forex market operates 24 hours a day, five days a week, across different global trading sessions:

Sydney: 10 p.m. – 7 a.m. GMT

Tokyo: 12 a.m. – 9 a.m. GMT

London: 8 a.m. – 5 p.m. GMT

New York: 1 p.m. – 10 p.m. GMT

When DST begins in the U.S., the New York session will open and close one hour earlier in GMT terms until Europe makes its own DST adjustment. If you trade during the London-New York overlap (typically the most liquid period), you’ll need to adjust your schedule accordingly.

2. Changes in Market Volatility

Forex trading is influenced by session overlaps, particularly between London and New York. A shift in these overlap periods due to DST can impact volatility and liquidity.

Before March 30: The London-New York overlap will be from 12 p.m. to 4 p.m. GMT instead of the usual 1 p.m. to 5 p.m. GMT.

After March 30: The typical overlap timing resumes.

If you rely on volatility in these hours, you may need to tweak your strategy during this transitional period.

3. Timing of Economic Events

Economic news releases, such as Federal Reserve announcements, GDP reports, and Non-Farm Payroll (NFP) data, are scheduled according to local time. When DST starts in the U.S., these events occur an hour earlier for traders outside the U.S. If you trade around news events, check the updated release times to avoid missing critical opportunities or getting caught in unexpected volatility.

4. Impact on Spreads and Slippage

Some brokers adjust their server times with DST, which can temporarily affect spreads and execution speeds. Wider spreads and increased slippage may occur in the days following the time change, especially around market open. Traders using stop-loss and take-profit orders should review their risk management settings to avoid unnecessary losses.

How to Adjust Your Trading Strategy for DST

Here are some practical tips to navigate forex trading during DST changes:

✔ Check Market Hours: Use a world clock to ensure you're trading at the right times.

✔ Adjust for Volatility Shifts: If your strategy depends on session overlaps, be aware of when these change.

✔ Stay Updated on Economic Events: Watch for any shifts in economic news releases due to time changes.

✔ Use Limit Orders: This can help reduce the risk of slippage during periods of increased volatility.

✔ Communicate with Your Broker: Some brokers adjust their trading hours or server times. Check with them to see if any changes will affect your trading conditions.

Final Thoughts

Daylight Saving Time may seem like a small adjustment, but it can have a noticeable impact on forex trading, especially during the transition period. By staying informed and adjusting your trading schedule, you can continue trading effectively without unnecessary disruptions.

How do you handle DST shifts in your forex trading? Let me know in the comments!

For support, contact us at support@easyindicators.com.